XRP vs. The SEC: The Legal War That Could Redefine Crypto Forever

- Editor

- Dec 5, 2025

- 6 min read

A Five-Year Battle. Billions at Stake. A Precedent That May Shape the Next Decade of Digital Asset Regulation.

Introduction: A Token Put on Trial

On December 22, 2020, the U.S. Securities and Exchange Commission dropped a legal bombshell that sent shockwaves across global crypto markets. The agency sued Ripple Labs and its top executives, alleging the company sold $1.3 billion worth of XRP as an unregistered security, turning one of the world’s largest cryptocurrencies into a defendant overnight. XRP collapsed more than 50% within hours. American exchanges rushed to delist it. For months, headlines questioned whether Ripple was finished — and whether the SEC had just declared war on all of crypto.

Five years later, in August 2025, the dust finally settled. XRP closed the legal chapter with a nuanced but powerful victory that transformed its regulatory destiny — and potentially that of the entire crypto ecosystem.

This is the story of how one lawsuit became the most important legal battle in crypto history, why it mattered far beyond one token, and how the outcome could shape regulation for years to come.

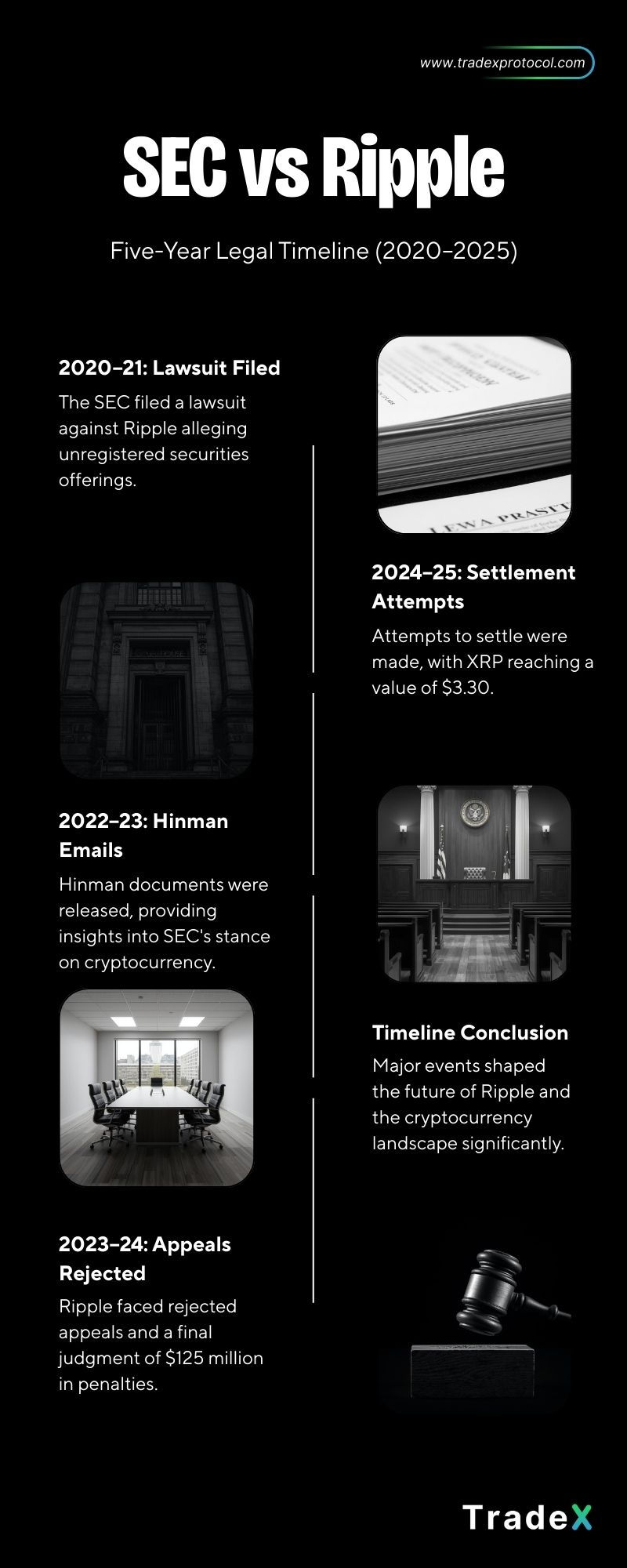

The Five-Year Timeline: How a Lawsuit Became Crypto’s Defining Case

2020 — The Shock: SEC Sues Ripple

December 22, 2020

The SEC sues Ripple Labs, CEO Brad Garlinghouse, and Executive Chairman Chris Larsen, claiming XRP sales constituted an unregistered securities offering worth $1.3 billion. Courts had never ruled definitively on whether a digital asset could be a security, so this case became an immediate industry bellwether.

Market carnage followed:

XRP plunged from $0.44 to under $0.20 within hours.

U.S. exchanges delisted XRP overnight.

Billions in market cap evaporated.

Ripple vowed to fight. XRP holders, unusually vocal compared to other crypto communities, mobilized behind the company — filing amicus briefs and creating what became known as the “XRP Army.”

2021–2022 — Discovery Fights, Hinman Emails & Early Wins

Throughout 2021, both sides battled over evidence. One major breakthrough came when Judge Analisa Torres ordered the SEC to produce internal drafts and emails relating to a 2018 speech by former SEC Director William Hinman — a speech that appeared to classify Ether as not a security.

Ripple argued this undercut the SEC’s claims and bolstered its fair notice defense: the idea that the SEC never clearly told the industry that XRP could be a security.

In September 2022, the judge forced the SEC to hand over the Hinman documents, a huge legal victory for Ripple. Over a dozen major crypto companies — Coinbase included — filed amicus briefs supporting Ripple. The case was no longer just Ripple vs. SEC. It had become Crypto vs. SEC.

July 2023 — The Landmark Ruling That Shook Crypto

On July 13, 2023, Judge Torres issued one of the most important rulings in crypto history:

Her ruling split XRP sales into two categories:

1. Institutional Sales → XRP was a security.

Ripple sold XRP directly to institutional investors who clearly expected Ripple’s efforts to increase XRP’s value.

2. Programmatic Exchange Sales → XRP was NOT a security.

Retail buyers purchasing through exchanges had no idea who they were buying from — and no reason to expect Ripple to increase the price.

This distinction — the context of a token sale matters — became a groundbreaking precedent.

Market reaction was explosive:

XRP pumped over 70% in a day.

Coinbase, Kraken, and others relisted XRP within hours.

XRP reclaimed a top-5 market cap position.

For the first time, a federal court ruled that a token in itself is not inherently a security.

2023–2024 — SEC Pushes Back, Ripple Holds Its Ground

The SEC tried to appeal immediately, arguing the ruling contradicted other cases. The judge rejected the attempt.

The agency then dropped all charges against Ripple’s executives. What remained was determining penalties for institutional sales.

In August 2024, the court issued the final judgment:

Ripple to pay $125 million in civil penalties.

No restriction on XRP trading.

XRP programmatic sales officially not securities.

The SEC had wanted nearly $2 billion. The final fine was a fraction of that.

2025 — The Endgame: Appeals Dropped, Clarity Delivered

By early 2025, settlement talks accelerated. A proposed $50 million reduction was rejected by the judge, who refused to vacate the ruling.

Then came the finale:

August 7, 2025

Ripple and the SEC both dropped their appeals.The five-year battle officially ended.

Ripple paid the penalty. XRP got clarity. The landmark ruling stood.

XRP skyrocketed to over $3.30, its highest price in years, reclaiming a top-three crypto ranking.

The lawsuit — once seen as an existential threat — ended with XRP becoming one of the few tokens with clear regulatory status in the U.S.

The Core Legal Question: Is XRP a Security?

To understand why this case mattered, we must revisit the central question: Does XRP meet the Howey Test?

The Howey Test determines whether something is an “investment contract” — a security — based on:

Investment of money

In a common enterprise

With the expectation of profit

From the efforts of others

What the SEC argued

The SEC claimed XRP sales were no different from selling shares — that investors relied on Ripple’s work to increase XRP’s value. XRP, they said, had no independent utility, and Ripple’s executives promoted it like a stock.

What Ripple argued

Ripple countered:

XRP is a currency, used for payments.

XRP holders on exchanges bought blindly, without contracts or promises.

No “common enterprise” tied all XRP holders to Ripple.

Utility existed well beyond Ripple (especially abroad).

Ripple also cited FinCEN’s 2015 settlement categorizing XRP as a virtual currency, not a security — showing regulatory inconsistency.

What the court ruled

Judge Torres made a groundbreaking distinction:

Institutional sales were securities — because they involved contracts and clear expectation of profit.

Exchange sales were NOT securities — because anonymous retail buyers could not reasonably rely on Ripple’s efforts.

The key message: a token is not a security by itself — only certain transactions involving that token can be.

This nuance will influence crypto law for decades.

Market Reaction: How XRP’s Price Reflected the Courtroom Drama

XRP’s five-year price chart mirrors this legal rollercoaster.

2020: The crash

XRP plummeted 50% in a day after the lawsuit.

2021–2022: Resilience and global support

Despite delistings in the U.S., global exchanges kept trading XRP. The community remained one of the strongest in crypto.

2023: The rally after the ruling

XRP pumped over 70% after the summary judgment and returned to U.S. exchanges.

2024–2025: Consolidation & momentum

As settlement signals emerged, XRP traded steadily in the $0.70–$0.80 range — until the final ruling.

August 2025: The explosive comeback

When appeals were dropped and the case was closed:

XRP soared to $3.34.

Trading volume surged.

XRP re-entered the top three cryptocurrencies by market cap.

XRP had gone from regulatory pariah to one of the clearest legal victories in crypto history.

The Bigger Picture: How the Case Reshapes Crypto Regulation

1. Context-based token classification is the new standard

The ruling established that:

“A digital token is not a security. Certain transactions involving that token may be.”

This single idea could redefine regulatory frameworks.

2. Other cases now cite Ripple

The Ripple ruling already influences:

SEC v. Coinbase

SEC v. Binance

SEC v. Terraform Labs

Multiple token litigations

Courts are no longer accepting the SEC’s broad “all tokens are securities” stance.

3. Congress accelerates crypto legislation

Ripple became a political flashpoint. By 2025:

The CLARITY Act and FIT21 Act gained traction.

Bipartisan support emerged to define digital assets as commodities or securities based on functionality, not agency interpretation.

The CFTC gained increasing relevance in oversight discussions.

4. Ripple emerges stronger than ever

With legal uncertainty removed, Ripple is focusing on:

CBDC pilots

Global payment corridors

A potential XRP ETF (Japan’s SBI already filed an XRP-linked fund proposal)

New enterprise partnerships previously blocked by U.S. legal concerns

Ripple is now one of the most legally vetted crypto companies in the world.

Conclusion: Why XRP vs. SEC Will Be Remembered as a Landmark Case

The SEC vs. Ripple battle was never just about one token. It became a referendum on how 80-year-old securities laws apply to decentralized digital assets.

What the case achieved:

Proved that tokens themselves are not securities

Set the precedent that context matters

Reopened the door for U.S. crypto innovation

Empowered exchanges to relist previously “at-risk” tokens

Spurred lawmakers to push for clearer legislation

Restored billions in market value and confidence

It also showed the crypto industry something deeper: fighting back works. Ripple refused to settle, and that resistance created the most important legal precedent in crypto so far.

As Ripple’s CEO Brad Garlinghouse said after the pivotal 2023 ruling:

“It’s not just a win for Ripple. It’s a win for crypto innovation in the United States.”

About TradeX

TradeX is redefining modern investing through data, discipline, and automation.

We blend AI-powered execution with human oversight — ensuring profits are consistent, not emotional.

Follow TradeX Protocol for weekly insights on wealth, mindset, and modern investing — where human wisdom meets algorithmic intelligence.

Smart Capital Allocation | Global Markets | Trusted Returns

Comments